Written by:

Josh Carr

Senior Director of Lending

Kinetic Advantage

Contents in this Article

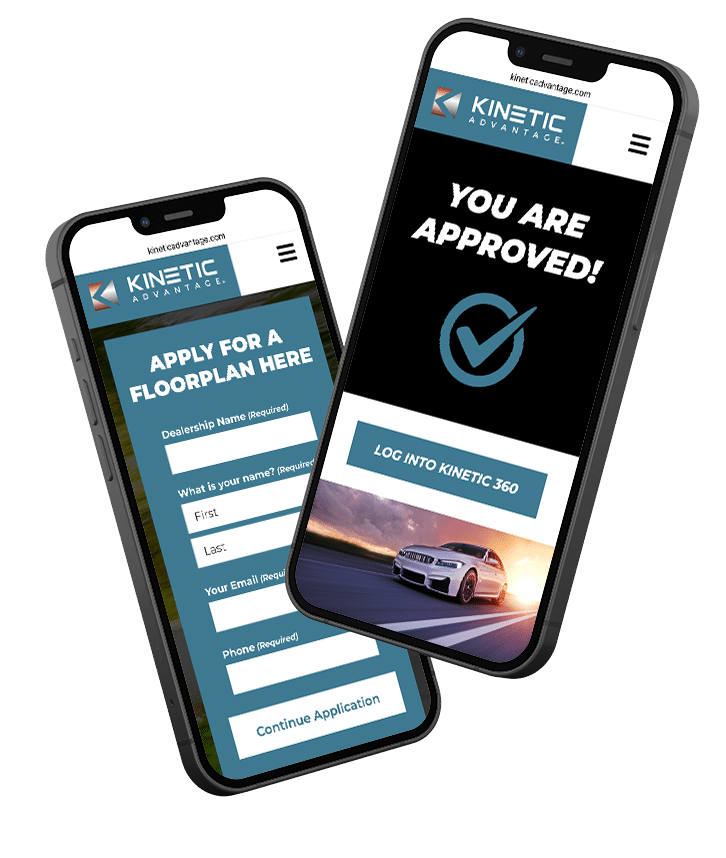

As an independent car dealer, securing a line of credit or floorplan financing is crucial for maintaining steady inventory and sustaining your business operations.

At Kinetic Advantage, we understand the unique challenges faced by dealers in the ever-evolving automotive industry.

Our goal is to provide you with the resources and guidance necessary to navigate the process of establishing a floorplan line of credit successfully.

The Core Requirements for Floorplan Financing

Before we delve into the application process, it’s essential to understand the core requirements that lenders typically evaluate. These factors play a pivotal role in determining your eligibility and the terms of your floorplan financing.

Preparing for the Application Process

Once you have determined your eligibility based on these core requirements, it’s time to prepare for the application process.

Here are some tips to increase your chances of success:

▪ Gather Documentation

Depending on the size of credit you’re requesting, lenders will require a range of documents. If a smaller request, expect to submit recent bank statements along with other standard items such as competitor statements. If a larger request, it would likely include financial statements, tax returns, proof of assets, and possibly business plans. Ensure that all documentation is accurate, up-to-date, and organized for a smooth application process.

▪ Defined Business Model

A well-crafted business model demonstrates your vision, strategies, and projections for the dealership. Whether documented within a business plan or verbally shared during the application process, sharing the way in which you conduct your dealership’s operations showcases your understanding of the market and your ability to manage and grow the business effectively.

▪ Maintain Transparent Communication

Be prepared to provide detailed explanations and clarifications throughout the application process. Lenders value transparency and open communication, as it builds trust and confidence in your ability to manage the line of credit responsibly.

▪ Highlight Your Strengths

Identify and emphasize your unique selling points, such as specialized expertise, a niche market focus, or a proven track record in a particular segment of the automotive industry.

▪ Consider Collateral

Depending on the lender’s requirements, you may need to provide collateral to secure the line of credit. This could include real estate, inventory (that is not being floored), or other valuable assets. Specialized floorplan lenders like Kinetic Advantage will have custom options that may include other assets outside of this list.

A Collaborative Partnership

A dealership floor plan experience with Kinetic includes top-notch service, local support, and a collaborative partnership.

At Kinetic Advantage, we understand that securing floorplan financing is a critical step in the growth and success of your dealership. Our experienced team is dedicated to guiding you through the process, addressing your concerns, and providing tailored solutions to meet your specific needs.

Remember, establishing a line of credit is not just about meeting the lender’s criteria; it’s also an opportunity to demonstrate your commitment, expertise, and vision as an independent car dealer. By following these tips and maintaining a proactive approach, you can increase your chances of securing the financing you need to drive your business forward.

What Drives You?

What Drives You?

The dealership floorplanning newsletter that takes a look into recent floorplan news & trends, as well as updates from inside the walls at Kinetic Advantage.

(We promise not to spam you or inundate your inbox with emails. Our newsletter goes out roughly twice per month to include important news and information around dealer floorplanning.)